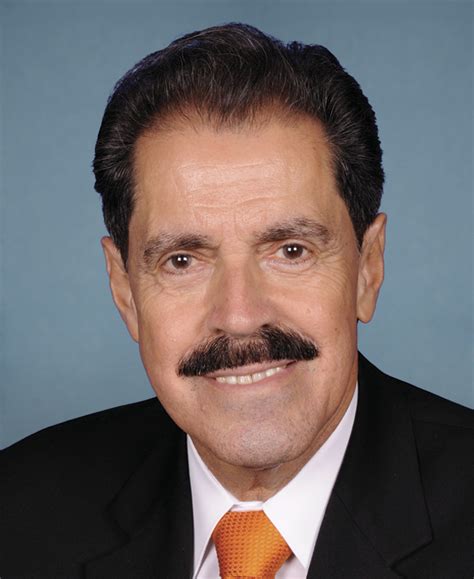

A Quote by Jose Serrano

Sadly, this is the same old Republican story of Robin Hood in reverse - tax cuts for the rich while programs for average and low income Americans suffer.

Related Quotes

The people who are having the hard time right now are middle-income Americans. Under the president's policies, middle-income Americans have been buried. They're just being crushed. Middle-income Americans have seen their income come down by $4,300. This is a tax in and of itself. I'll call it the economy tax. It's been crushing.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

Most Americans living below the official poverty line own a car or truck - and government entitlement programs seldom provide cars and trucks. Most people living below the official poverty line also have air conditioning, color television, and a microwave oven - and these too are not usually handed out by government entitlement programs.

Cell phones and other electronic devices are by no means unheard of in low-income neighborhoods, where children would supposedly go hungry if there were no school-lunch programs. In reality, low-income people are overweight more often than other Americans.

In December, I agreed to extend the tax cuts for the wealthiest Americans because it was the only way I could prevent a tax hike on middle-class Americans. But we cannot afford $1 trillion worth of tax cuts for every millionaire and billionaire in our society. We can't afford it. And I refuse to renew them again.

The tax that was supposed to soak the rich has instead soaked America. The beneficiary of the income tax has not been the poor, but big government. The income tax has given us a government bureaucracy that outnumbers the manufacturing work force. It has created welfare dependencies that have entrapped millions of Americans in an underclass that is forced to live a sordid existence of trading votes for government handouts.

People in my hometown voted for President Reagan - for many, like my grandpa, he was their first Republican - because he promised that tax cuts would bring higher wages and new jobs. It seemed he was right, so we voted for the next Republican promising tax cuts and job creation, George W. Bush. He wasn't right.

Raising the minimum wage and lowering the barriers to union organization would carry a trade-off - higher unemployment. A better idea is to have the government subsidize low-wage employment. The earned-income tax credit for low-income workers - which has been the object of proposed cuts by both President Clinton and congressional Republicans - has been a positive step in this direction.