A Quote by Joseph A. Schumpeter

The banker, therefore, is not so much primarily a middleman in the commodity "purchasing power" as a producer of this commodity. However, since all reserve funds and savings today usually flow to him, and the total demand for free purchasing power, whether existing or to be created, concentrates on him, he has either replaced private capitalists or become their agent; he has himself become the capitalist par excellence.

Related Quotes

An underpaid man is a customer reduced in purchasing power. He cannot buy. Business depression is caused by weakened purchasing power. Purchasing power is weakened by uncertainty or insufficiency of income. The cure of business depression is through purchasing power, and the source of purchasing power is wages.

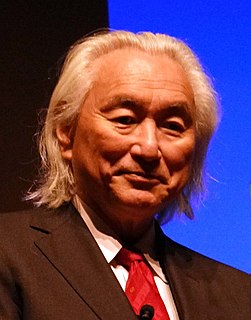

Broadly speaking, Keynesianism means that the government has a specific responsibility for the behavior of the economy, that it doesn't work on its own autonomous course, but the government, when there's a recession, compensates by employment, by expansion of purchasing power, and in boom times corrects by being a restraining force. But it controls the great flow of demand into the economy, what since Keynesian times has been the flow of aggregate demand. That was the basic idea of Keynes so far as one can put it in a couple of sentences.

Purchasing power parities are not a reasonable method for comparing households across countries or currencies. The reason for this is simply that PPPs are sensitive to the prices of all the commodities, goods and services, that households are consuming worldwide, with each commodity weighted in the calculations according to its share in international household consumption expenditure.

Any money the government spends must be taxed, borrowed or conjured out of thin air by the Federal Reserve, and that will reduce sound private investment. Obama has no real wealth to inject into the economy. He can only move around existing money while inflation robs us of purchasing power. Meanwhile, private investors who might have produced a better engine, battery, computer, cancer treatment or other wealth-creating and life-enhancing innovations hold back for fear that big government will undermine productive efforts.

The perfection of the effect demonstrates the perfection of the cause, for a greater power brings about a more perfect effect. But God is the most perfect agent. Therefore, things created by Him obtain perfection from Him. So, to detract from the perfection of creatures is to detract from the perfection of divine power.

Economic theory has nothing to say as to what commodity will acquire the status of money. Historically, it happened to be gold. But if the physical makeup of our world would have been different or is to become different from what it is now, some other commodity would have become or might become money. The market will decide.

It may seem strange, but Congress has never developed a set of goals for guiding Federal Reserve policy. In founding the System, Congress spoke about the country's need for "an elastic currency." Since then, Congress has passed the Full Employment Act, declaring its general intention to promote "maximum employment, production, and purchasing power." But it has never directly counseled the Federal Reserve.

Purchasing power is a license to purchase power. The old proletariat sold its labour power in order to subsist; what little leisure time it had was passed pleasantly enough in conversations, arguments, drinking, making love, wandering, celebrating and rioting. The new proletarian sells his labour power in order to consume. When he’s not flogging himself to death to get promoted in the labour hierarchy, he’s being persuaded to buy himself objects to distinguish himself in the social hierarchy. The ideology of consumption becomes the consumption of ideology.

Instability mostly comes from the interface between the fact that the banks (or shadow banks) can create credit, money, and purchasing power in infinite quantities if we don't constrain them, and the fact that credit is primarily created to fund the purchase of urban real estate and land, which is somewhat fixed in supply.