A Quote by Joseph Joubert

Professional critics are incapable of distinguishing and appreciating either diamonds in the rough or gold in bars. They are traders, and in literature know only the coins that are current. Their critical lab has scales and weights, but neither crucible or touchstone.

Related Quotes

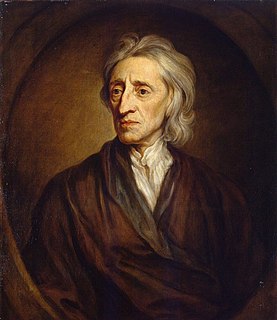

Every man carries about him a touchstone, if he will make use of it, to distinguish substantial gold from superficial glitterings, truth from appearances. And indeed the use and benefit of this touchstone, which is natural reason, is spoiled and lost only by assuming prejudices, overweening presumption, and narrowing our minds.

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

Friendship is a priceless gift, that cannot be bought or sold. But it's value is far greater than a mountain made of gold. For gold is cold and lifeless, it can neither see nor hear. And in time of trouble, it is powerless to cheer. So when you ask God for a gift, be thankful if he sends not diamonds, pearls or riches, but the love of real true friends.