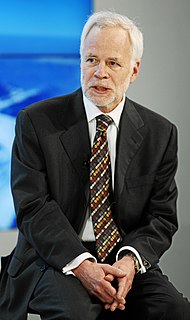

A Quote by Joseph Stiglitz

In the end, the politics of the euro zone weren't strong enough to create a fully integrated fiscal union with a common banking system, etc.

Related Quotes

We need to move forward, from the common currency to the banking union to a common financial policy and, in the middle-term, to a common foreign and security policy. That will take time, because we need to figure out how to deal with those countries that don't always want a more tightly integrated European Union.

Germany has always stood for an E.U. of the 27 countries. But in light of Britain's continued resistance to further integration steps, as we saw with the fiscal pact, there are limits to my optimism in this regard. It's quite possible that we will have to create the new institutions for the euro zone first.

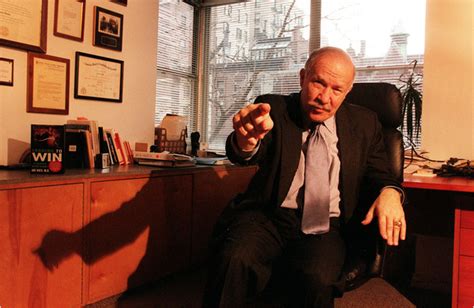

Most traders believe that 'getting into the zone' happens when you have 'a hot streak.' I believe you can create the zone. The zone is a psychological state. It is when you are focused, disciplined, and fully engaged in the process at hand . . . trading in the zone will certainly increase your capacity to perform and succeed.