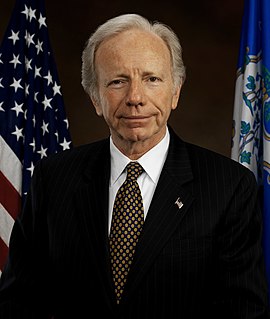

A Quote by Joseph Stiglitz

In addition to offering benefits to those who invest, carry out research, and create jobs, higher taxes on land and real-estate speculation would redirect capital toward productivity-enhancing spending - the key to long-term improvement in living standards.

Related Quotes

I argue that in the long run, the US would be on a far more financially secure footing if we recalibrate how we spend about two-to-three percent of the country's GNP, using state and federal taxes to create pools of money for spending on America's poor - which would, as numerous economists have argued in recent years, create virtuous spending circles, since those on lower incomes spend more of each extra dollar in their possession than do those on higher incomes.

The Federal Reserve's objectives of maximum employment and price stability do not, by themselves, ensure a strong pace of economic growth or an improvement in living standards. The most important factor determining living standards is productivity growth, defined as increases in how much can be produced in an hour of work.

Through our government's updated science, technology and innovation strategy, we are making the record investments necessary to push the boundaries of knowledge, create jobs and opportunities, and improve the quality of life of Canadians. Our government's Canada Research Chairs Program develops, attracts and retains top talent researchers in Canada whose research, in turn, creates long-term social and economic benefits while training the next generation of students and researchers in Canada.

The Six-Day War laid a foundation of deep hatred toward Israel 50 years ago. I said this at a very early moment back then, when people were chanting about liberating ancestral land. I was quick to say that regardless of the future of these territories, liberated they are not, because the term liberation only applies to human beings and not to land, not to real estate.

The left does understand how raising taxes reduces economic activity. How about their desire for increasing cigarette taxes, soda taxes? What are they trying to do? Get you to buy less. They know. They know that higher taxes reduce activity. It's real simple: If you want more of an activity, lower taxes on it. If you want less of an activity, raise taxes. So if you want more jobs? It's very simple. You lower payroll taxes. If you don't want as many jobs, then you raise corporate taxes. It's that simple, folks.