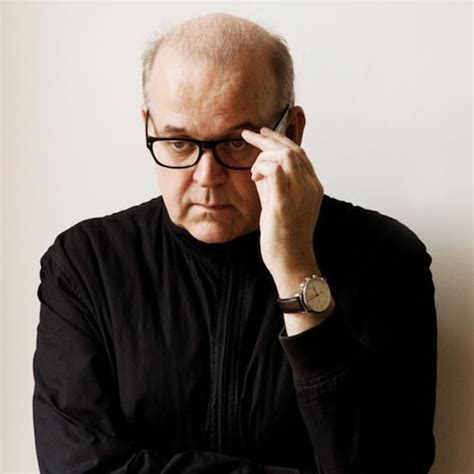

A Quote by Joseph Stiglitz

The laws of normal economics dictate that lower taxes combined with increased spending will lead to bigger deficits.

Related Quotes

Lower taxes will stimulate your own personal economy by leaving more money in your pocket to do what you want - invest, save, spend, buy a bigger house, a nicer car, and give to charity. And lower taxes also lead to more money for the government to use on those things they've promised you. It's a win-win for everyone.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

When a party can't think of anything else they always fall back on Lower Taxes. It has a magic sound to a voter, just like Fairyland is spoken of and dreamed of by all children. But no child has ever seen it; neither has any voter ever lived to see the day when his taxes were lowered. Presidents have been promising lower taxes since Washington crossed the Delaware by hand in a row boat. But our taxes have gotten bigger and their boats have gotten larger until now the President crosses the Delaware in his private yacht.