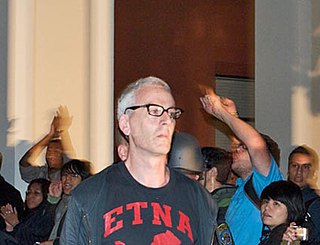

A Quote by Joshua Clover

I don't want to overvalue Donald Trump as some historical rupture, and to admit that I do think Trump is an indication of a fairly profound change. But the change started a while ago, and it has taken a while to appear. Global capital, particularly western capital, has been in decline since the late 60s and early 70s. The softness appeared in the 60s, the profit rate fell off the table in 1972 - 73, and there have been very uneven recoveries. This has been an ongoing weakening of the productive economy of accumulation at a global scale, of capital's capacity to expand.

Quote Topics

Accumulation

Admit

Appear

Appeared

Been

Capacity

Capital

Change

Decline

Donald

Donald Trump

Early

Economy

Expand

Fairly

Fell

Global

Historical

Indication

Late

Off

Ongoing

Particularly

Productive

Profit

Profound

Rate

Rupture

Scale

Since

Softness

Some

Started

Table

Taken

Think

Trump

Uneven

Very

Want

Weakening

Western

While

Related Quotes

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

Remember that accumulated knowledge, like accumulated capital, increases at compound interest: but it differs from the accumulation of capital in this; that the increase of knowledge produces a more rapid rate of progress, whilst the accumulation of capital leads to a lower rate of interest. Capital thus checks it own accumulation: knowledge thus accelerates its own advance. Each generation, therefore, to deserve comparison with its predecessor, is bound to add much more largely to the common stock than that which it immediately succeeds.

Well, certainly the Democrats have been arguing to raise the capital gains tax on all Americans. Obama says he wants to do that. That would slow down economic growth. It's not necessarily helpful to the economy. Every time we've cut the capital gains tax, the economy has grown. Whenever we raise the capital gains tax, it's been damaged.

The idea that the profits of capital are really the rewards of a just society for the foresight and thrift of those who sacrificed the immediate pleasures of spending in order that society might have productive capital, had a certain validity in the early days of capitalism, when productive enterprise was frequently initiated through capital saved out of modest incomes.

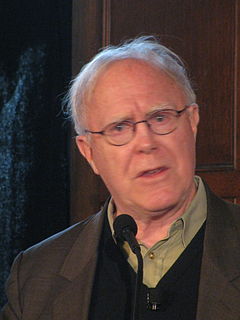

When I began writing poems, it was in the late 60s and early 70s when the literary and cultural atmosphere was very much affected by what was going on in the world, which was, in succession, the civil rights movement, the antiwar movement, and the women's movement in the 60s, 70s, and into the early 80s. And all of those things affected me and affected my thinking, particularly the Vietnam War.

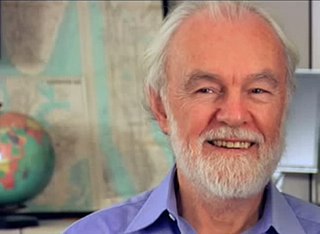

Neoliberalization has not been very effective in revitalizing global capital accumulation, but it has succeeded remarkably well in restoring, or in some instances (as in Russia and China) creating, the power of an economic elite. The theoretical utopianism of neoliberal argument has, I conclude, primarily worked as a system of justification and legitimation for whatever needed to be done to achieve this goal.

My experience to date has been that change, particularly relative to business, rarely happens in a revolutionary way. That isn't to say there are not times when major change happens, but my experience is that particularly when you're encouraging businesses to change of their own volition, the change is more slow over time. I don't think global trade is going to go away. I think it's unlikely that global trade and multinationals are not going to be around.

People hear from Donald Trump that he's such an extraordinary success. They didn't know about Trump airlines and Trump mortgages and Trump vitamin network and Trump steaks and Trump Taj Mahal. They didn't realize a lot of small people have been crushed by Donald Trump's rise to become a very wealthy man, successful financially, but this is a guy who has not been a uniform success.

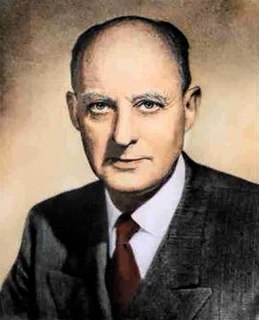

There are but three political-economic roads from which we can choose... We could take the first course and further exacerbate the already concentrated ownership of productive capital in the American economy. Or we could join the rest of the world by taking the second path, that of nationalization. Or we can take the third road, establishing policies to diffuse capital ownership broadly, so that many individuals, particularly workers, can participate as owners of industrial capital. The choice is ours.