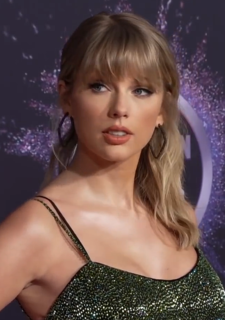

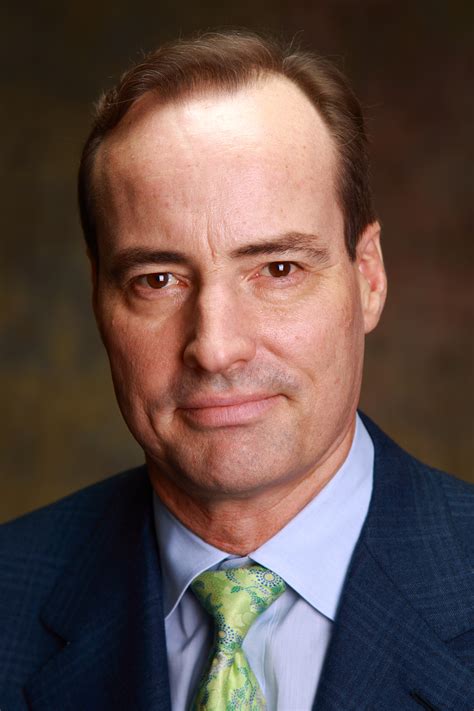

A Quote by Juan Williams

In 2008, when the real estate market blew up, it principally hurt older people who saw the value of their houses go down, along with their pension plans.

Quote Topics

Related Quotes

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.

Today the strategies of many companies in the real estate industry are premised on low interest rates, an assumption that has resulted in the rapid expansion of the real estate securitization business. This trend could be regarded as a risk factor, as it exposes the real estate sector to at least three potential problems: first, interest rate hikes; second, revisions to securitization business accounting standards; and third, overheating in the real estate market.

I would buy a house, and try to buy a house every month. I didn't have education or information about real estate at the time. I learned after I bought a few houses, and then I kind of fell in love with the rehabbing of the houses and fixing them up and just the whole process and turned it into a business.