A Quote by Julian Robertson

I think, definitely, this country needs a lower corporate tax rate and tax reform so that we can get our profits that we've made overseas back into the country without heavy penalties. And if that happens, I think that would be very good for the market and all of that.

Related Quotes

Corporate tax reform is nice in theory but tough in practice. It most likely requires lower tax rates and the closing of loopholes, which many companies are sure to fight. And whatever new, lower tax rate is determined, there will probably be another country willing to lower its rate further, creating a sad race to zero.

God forbid that the United Kingdom should take a lead and introduce a sensible tax system of its own which would probably comprise a very low level of corporation tax - tax on corporate profits - and perhaps a low level of corporate sales tax, because sales are where they are, and sales in this country are sales here, which we can tax here.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

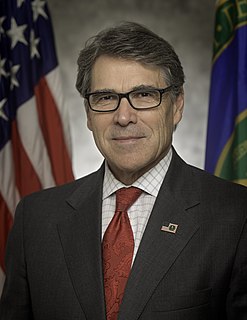

Canada, the United States and Mexico, we developed these energy reserves that we have in this North American region. And you can see a not only driving down the cost of electricity but a major manufacturing boom in this country. Couple that with tax policy, reduction, reducing the corporate tax rate, and that I think a renaissance in manufacturing like we've never seen in this country and really drive the economy.

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

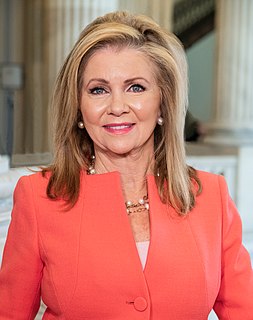

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

We're bringing the corporate rate down to 20 percent from 35 percent. That's a massive - this will be the biggest tax cut in history. In the history of our country. And that's great. And we need it. Because right now, our country's about the highest taxed or certainly one of the highest taxed in the world. And we can't have that. So we're going to have a country that's toward the lower end.

Research has shown that middle-income wage earners would benefit most from a large reduction in corporate tax rates. The corporate tax is not a rich-man's tax. Corporations don't even pay it. They just pass the tax on in terms of lower wages and benefits, higher consumer prices, and less stockholder value.