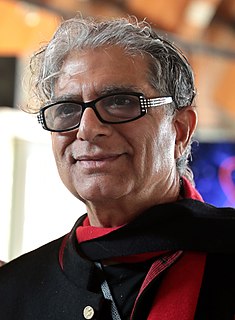

A Quote by Kabir Sehgal

We are privileged that the dollar is the "currency of last resort" and the most important currency in the world. Global commodities are priced in dollars. Central banks in other countries hold great quantities of dollars. The dollar was the safe harbor, the port in the storm during the credit crisis.

Related Quotes

Most paper money initially existed as a substitute for gold. That's what gave it value. But right now what gives a currency value is other currency. Most countries hold reserves and the reserves are other currencies. If you are a backing up the euro with the dollar, what's backing up the dollar? I don't think it is going to go to a point where all you have is coins and bars of gold, but I do think that we are going to have to go back to a monetary system based in gold, not based on paper.

My single biggest financial concern is the loss of the dollar as the reserve currency. I can't imagine anything more disastrous to our country. . .you're already seeing things in the markets that are suggesting that confidence in the dollar is waning. . .I think you could see a 25% reduction in the standard of living in this country if the U.S. dollar was no longer the world's reserve currency. That's how valuable it is.

Over time, there's a very close correlation between what happens to the dollar and what happens to the price of oil. When the dollar gets week, the price of oil, which, as you know, and other commodities are denominated in dollars, they go up. We saw it in the '70s, when the dollar was savagely weakened.

I hold all idea of regulating the currency to be an absurdity; the very terms of regulating the currency and managing the currency I look upon to be an absurdity; the currency should regulate itself; it must be regulated by the trade and commerce of the world; I would neither allow the Bank of England nor any private banks to have what is called the management of the currency.

If all the bank loans were paid, no one could have a bank deposit, and there would not be a dollar of coin or currency in circulation. This is a staggering thought. We are completely dependent on the commercial banks. Someone has to borrow every dollar we have in circulation, cash, or credit. If the banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless situation is almost incredible - but there it is.

The United States is pushing as policy division of the world into rival currency camps - the dollar area on the one hand, and the Russia-Chinese-Shanghai Cooperation Organization group on the other, especially now that the IMF has changed its rules. People think that if there are rival currency groupings and national currencies are going bust, we might as well use gold as a safe haven.

The primary factor that enables our government to peddle economic snake oil is the dollar's unique role as the world's reserve currency, and our creditors' willingness to preserve its status. By buying up dollars and loaning them back to us through Treasury debt, productive countries give American politicians cart blanche to play Santa Claus.

This is the first global crisis that doesn't start in poor countries and it was caused by the rich countries. So it's necessary to take advantage of this crisis - the financial system has to be regulated. It's necessary that the central banks in the world should control a little bit the banks' financing, because they cannot bypass a certain range of leverage. And I believe that there's no other - more any reason for a G-8 group or any other "G." I believe that we should guarantee that the G-20 should be now an important forum to discuss the major economic issues of the world.