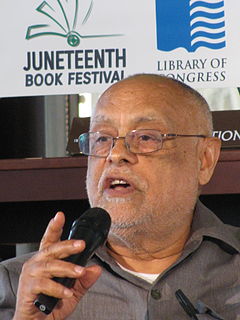

A Quote by Kalle Lasn

We got rich by violating one of the central tenets of economics: thou shall not sell off your capital and call it income. And yet over the past 40 years we have clear-cut the forests, fished rivers and oceans to the brink of extinction and siphoned oil from the earth as if it possessed an infinite supply. We've sold off our planet's natural capital and called it income. And now the earth, like the economy, is stripped.

Related Quotes

How is it that we have created an economic system that tells us it is cheaper to destroy the earth and exhaust its people than to nurture them both? Is it rational to have an pricing system which discounts the future and sells off the past? How did we create an economic system that confused capital liquidation with income?

Most of the people in the upper income brackets are not rich and do not have wealth sheltered offshore. They are typically working people who have finally reached their peak earning years after many years of far more modest incomes-and now see much of what they have worked for siphoned off by politicians, to the accompaniment of lofty rhetoric.

If surface water can be compared with interest income, and non-renewable groundwater with capital, then much of the West was living mainly on interest income. California was milking interest and capital in about equal proportion. The plains states, however, were devouring capital as a gang of spendthrift heirs might squander a great capitalist's fortune.

Why do we fully tax some kinds of income from capital, like interest and dividends; partially tax other kinds like capital gains; defer tax on other kinds, like IRAs; and impose no tax at all on still other types of capital income, like interest on municipal bonds? This simply is not rational. These distinctions don't have any inherent logic.

Virtually, Finnish woods are stripped so bare, so sold out and first and foremost, so long way off from genuine diverse natural forest, that the resources of language will not permit excessive words. Finnish forest economy has been compared to the ravaging of rain forests. Nevertheless, the noteworthy difference is that there is a half or two thirds left from rain forests, but from Finnish forests there is left - excluding arctic Lapland - 0,6 per cent.