A Quote by Karl Lauterbach

In Germany there is ranking for contribution rate, so the cheaper sickness funds with good quality can both advertise their better quality plus their lower contribution rates and therefore be gaining members. We had about 240 sickness funds a couple of months ago; we are now down to 213, I think. In two or three years, only 50 or so will survive.

Related Quotes

The same drugs are way cheaper in Germany than in America because, obviously, if all sickness funds negotiate with the drug companies for a single price, then the market power of the sickness funds is fully used. So therefore you would expect the prices to be lower for the drugs in Germany, and this is exactly what you see, at least for non-generic drugs.

The rate of growth of the relevant population is much greater than the rate of growth in funds, though funds have gone up very nicely. But we have been producing students at a rapid rate; they're competing for funds and therefore they're more frustrated. I think there's a certain sense of weariness in the intellectual realm, it's not in any way peculiar to economics, it's a general proposition.

I focus on faculty, as opposed to facilities, budgets, endowments or students. I do so because I believe, based on many decades of work as a teacher, a scholar and an administrator, that the quality of the faculty determines the quality of the university. Everything else flows from the quality of the faculty. If the faculty are good, you will attract good students and you will have alumni who will raise funds for you.

Even fans of actively managed funds often concede that most other investors would be better off in index funds. But buoyed by abundant self-confidence, these folks aren't about to give up on actively managed funds themselves. A tad delusional? I think so. Picking the best-performing funds is 'like trying to predict the dice before you roll them down the craps table,' says an investment adviser in Boca Raton, FL. 'I can't do it. The public can't do it.'

Here's the truth. The proposed top rate of income tax is not 50 per cent. It is 50 per cent plus 1.5 per cent national insurance paid by employees plus 13.3 per cent paid by employers. That's not 50 per cent. Two years from now, Britain will have the highest tax rate on earned income of any developed country.

Millions of mutual-fund investors sleep well at night, serene in the belief that superior outcomes result from pooling funds with like-minded investors and engaging high-quality investment managers to provide professional insight. The conventional wisdom ends up hopelessly unwise, as evidence shows an overwhelming rate of failure by mutual funds to deliver on promises.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

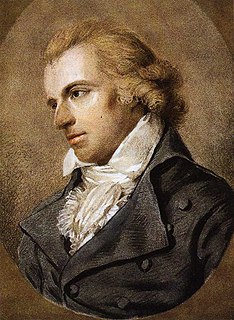

...Haller's sickness of the soul, as I now know, is not the eccentricity of a single individual, but the sickness of the times themselves, the neurosis of that generation to which Haller belongs, a sickness, it seems, that by no means attacks the weak and worthless only but, rather, precisely those who are strongest in spirit and richest in gifts.