A Quote by Kathy Szeliga

What hinders the middle class the most is taxes, and what hinders business from creating jobs and moving people into the middle class are regulations.

Quote Topics

Related Quotes

The most sinister of all taxes is the inflation tax and it is the most regressive. It hits the poor and the middle class. When you destroy a currency by creating money out of thin air to pay the bills, the value of the dollar goes down, and people get hit with a higher cost of living. It's the middle class that's being wiped out. It is most evil of all taxes.

The government decides to try to increase the middle class by subsidizing things that middle class people have: If middle-class people go to college and own homes, then surely if more people go to college and own homes, we’ll have more middle-class people. But homeownership and college aren’t causes of middle-class status, they’re markers for possessing the kinds of traits — self-discipline, the ability to defer gratification, etc. — that let you enter, and stay, in the middle class. Subsidizing the markers doesn’t produce the traits; if anything, it undermines them.

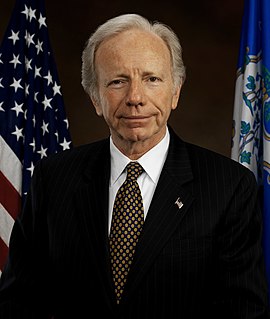

In America, we're being stripped of our jobs, our good jobs are really good down, and we've got to stop it. And the only way you're going to stop it, the nice way is, we're reducing taxes very substantially for companies so they're not going to have to leave because of taxes. We'll be reducing regulations. Now those are the nice ways of doing it and everyone loves it and everyone's happy. Businesses, way down. Also middle class, but way down, O.K., taxes and regulations.