A Quote by Katie Hill

My district has a large number of Independents, if you say anything about a 70 percent tax rate, you lose people right away.

Related Quotes

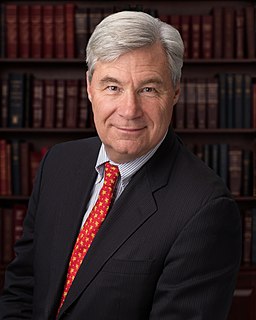

According to the IRS, the wealthiest 400 Americans, who earned an average of roughly $270 million in 2008, paid an average tax rate of just 18.2 percent that year. That's about the same rate paid by a single truck driver in Rhode Island. It's not right, and we need to restore fairness to our tax code.

The reason we've been growing at 1.8 percent for the last eight, ten years, which is way below the historical average, is in large part because of our tax code. It is important to us to get the biggest, broadest tax reduction, tax cuts, tax reform that we can possibly get because it's the only way we get back to 3 percent growth. That's what's driving all of this, how do you get the American economy back on that historical growth rate of 3 percent and out of these doldrums of 1.8, 1.9 that we had of the previous Barack Obama administration?

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

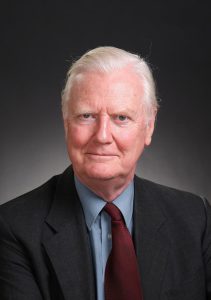

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

Well the thinking is we have the highest tax rate in the world. In the entire world, we have the highest tax rate. There's gridlock in Washington because there's no leadership. So what I'm doing is a large tax cut especially for the middle class and they're gonna- we're going to have a dynamic country. We're going to have dynamic economics. And it's going to be something really special. And people are going back to work.

First, the oil and gas business pays its fair share of taxes. Despite the current debate on energy taxes, few businesses pay more in taxes than oil and gas companies. The worldwide effective tax rate for our industry in 2010 was 40 percent. That's higher than the U.S. statutory rate of 35 percent and the rate for manufacturers of 26.5 percent.

About forty percent of the people vote Democrat. About forty percent vote Republican. Of those eighty percent, most wouldn't change their votes if Adolf Hitler was running against Abe Lincoln - or against FDR. . . . That leaves twenty percent of the people who swing back one way or another . . . the true independents. . . . That twenty percent controls the destiny of the country.

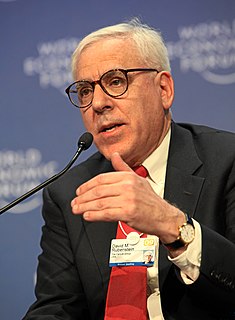

All I'm doing is I'm filling out my tax returns - or my accountants are, and I'm paying whatever I'm supposed to pay, though I'm giving away a large amount of the money and that probably lowers my tax rate because I'm giving away so much money. But change the law, but don't blame me for the law. I'm not writing the law. I didn't write the law.