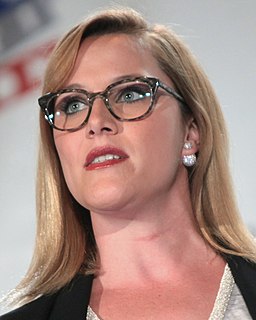

A Quote by Kay Ivey

We need a tax code that propels businesses to success rather than punishing them for their success.

Related Quotes

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.