A Quote by Kayla Tausche

When SoFi launched in 2011, it focused squarely on the burgeoning student loan market - a market that, unlike housing, had no viable option to refinance both federal and private student loans from higher interest-rate eras.

Related Quotes

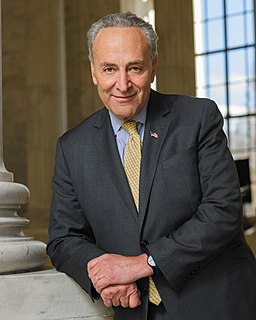

Student debt is crushing the lives of millions of Americans. How does it happen that we can get a home mortgage or purchase a car with interest rates half of that being paid for student loans? We must make higher education affordable for all. We must substantially lower interest rates on student loans. This must be a national priority.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

Mint's business model became, 'We'll go for free, and then we'll find these savings opportunities for you.' You know, better interest rate on your credit cards, when should you consolidate your student loans, when does it mathematically make sense to refinance your mortgage, and Mint figures all that stuff out for you.

The fact that you have government-guaranteed student loans has created a whole new sector in the American economy that didn't really exist before - private for-profit universities that sell junk degrees that don't help the students. They promise the students, "We'll help you get a better job. We'll arrange a loan so that you don't have to pay a penny for this education." Their pet bank gets them the government-guaranteed loan, and the student may get the junk degree, but doesn't get a job, so they don't pay the loan.

The higher amount you put into higher education, at the federal level particularly, the more the price of higher education rises. It's the dog that never catches its tail. You increase student loans, you increase grants, you increase Pell grants, Stafford loans, and what happens? They raise the price.