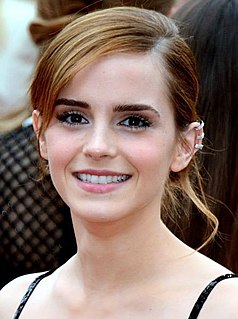

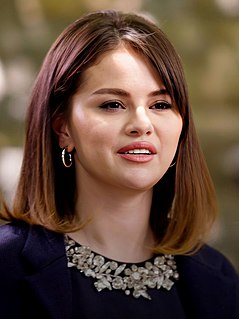

A Quote by Kelly Marie Tran

My parents are not of this world. I've had to work multiple jobs, been in a position where I cannot pay off student loans.

Quote Topics

Related Quotes

So we are in for years of debt deflation. That means that people have to pay so much debt service for mortgages, credit cards, student loans, bank loans and other obligations

that they have less to spend on goods and services. So markets shrink. New investment and employment fall off, and the economy is falls into a downward spiral.

Seventy-eight percent of millennials are worried about not having enough good paying job opportunity to pay off their student loans. Seventy-four percent can't pay the health care if they get sick. Seventy-nine percent don't have enough money to live when they retire. So, already, we're having a whole generation that's coming on, not only here but also in Europe, that isn't able to get good-paying jobs.