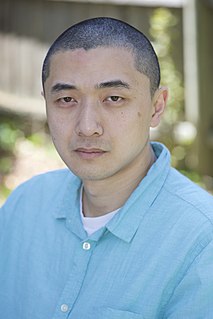

A Quote by Ken Liu

I was a tax attorney for something like seven years, so I was a tax geek. I was really into it. Tax is one of those things that people think is incredibly boring, but like any science about systems, once you get into it it, becomes incredibly intricate and interesting.

Related Quotes

One of the tax systems in the US is for wage earners. The government takes money from them out of each paycheck - so it knows how much they make, and those workers can't cheat to any significant degree. But the other tax system is for capital. Those with capital get to tell the government what they want to tell. They may get audited, but if their tax returns are of any size the government doesn't have enough of the smart auditors to figure out what's really going on. And there are the rules that allow you to do things like take in money today and pay taxes on it thirty years from now.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

If I get married I get a tax break, if I have a kid I get a tax break, if I get a mortgage I get a tax break. I don't have any kids and I drive a hybrid, I think I should get a tax break. I'm trying to pay off my apartment so I have something tangible. I actually figured out if I paid off my place my reward would be that I would pay an extra four grand a year in taxes.

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.