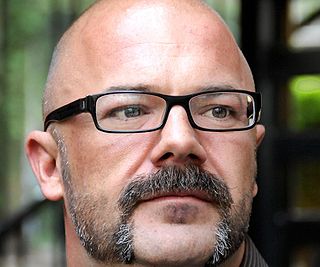

A Quote by Kenneth Arrow

There is a bit of a problem with the match between derivative securities markets and the primary markets. We have long ago instituted principles, essentially high margin requirements, to prevent certain instabilities in the stock market, and I think they're basically correct. The trouble is that there's a linkage, let's say, between something like the stock market and the index futures markets, and the fact that the margin requirements are very different, for example, played some role in the October '87 crash.

Quote Topics

Related Quotes

One doesn't like instabilities in markets; they may be damaging, but probably not fatal, as the October '87 crash showed. It turned out to be essentially inconsequential. So if that's true, I'm not very worried about the welfare of those who are investing any more than I am about the welfare of those who go into casinos.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.

Like its agriculture, Africa's markets are highly under-capitalized and inefficient. We know from our work around the continent that transaction costs of reaching the market, and the risks of transacting in rural, agriculture markets, are extremely high. In fact, only one third of agricultural output produced in Africa even reaches the market.

There are three important principles to Graham's approach. [The first is to look at stocks as fractional shares of a business, which] gives you an entirely different view than most people who are in the market. [The second principle is the margin-of-safety concept, which] gives you the competitive advantage. [The third is having a true investor's attitude toward the stock market, which] if you have that attitude, you start out ahead of 99 percent of all the people who are operating in the stock market - it's an enormous advantage.

History speaks pretty clearly that the markets do better with Democrats. Republicans' ideas of what constitutes fiscal responsibility simply are not good for the stock market. Democrats have many tendencies, but one of them is to look after the workers, and actually that tends to be good for demand and good for markets.

I think the sign of complacency in the stock market is when people don't worry. At the moment, everyone worries about everything. They worry about geopolitical risk, about political risk, they worry that the markets are too high. The time to really worry is when everyone thinks that markets are going up and everything is going really well.