A Quote by Kenneth C. Griffin

We're subject to the same forces of capitalism that have built the entire American economy. Strong returns induce more capital flow, which creates more competitors, and you have to evolve and get better, or you die.

Related Quotes

Doing the same things you did when the economy was good is not good enough. You will have to put more coals on the fire in a poor economy to get the same heat you received in a good economy. You must give more energy, more thought, more service, and get into positive thinking material more frequently. Become more selective about who you spend time with. Love a little more, hate a little less. Think about it. You can progressively move on an upward path toward any goal. The choice is yours as to who or what controls you!

The development of oil and gas resources depends more on capital than labour, and exporting oil and gas neither generates maximum returns from these precious resources nor creates large numbers of jobs within the local economy. As a result, the benefits are typically not shared broadly across society.

We can make market forces work better for the poor if we can develop a more creative capitalism-if we can stretch the reach of market forces so that more people can make a profit, or at least make a living, serving people who are suffering from the worst inequities. ... You have more than we had; you must start sooner, and carry on longer.

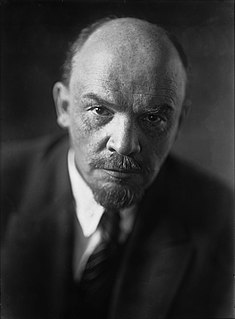

The American capitalists are richer and stronger than their counterparts in other lands. They are also younger and more ignorant, and therefore more inclined to seek a rough settlement of difficulties without diplomatic subtlety and finesse. All that does not change the fact that American capitalism operates according to the same laws as the others, is confronted with the same fundamental problems, and is headed toward the same catastrophe.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.