A Quote by Kenneth C. Griffin

Our financial markets work best when they are competitive, fair, and transparent.

Quote Topics

Related Quotes

To restore confidence in our markets and our financial institutions so they can fuel continued growth and prosperity, we must address the underlying problem. The federal government must implement a program to remove these illiquid assets that are weighing down our financial institutions and threatening our economy.

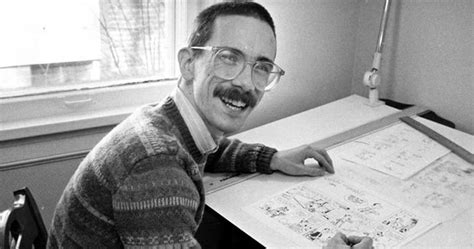

Saturday morning cartoons do that now, where they develop the toy and then draw the cartoon around it, and the result is the cartoon is a commercial for the toy and the toy is a commercial for the cartoon. The same thing's happening now in comic strips; it's just another way to get the competitive edge. You saturate all the different markets and allow each other to advertise the other, and it's the best of all possible worlds. You can see the financial incentive to work that way. I just think it's to the detriment of integrity in comic strip art.

We live in a very risky world and investors should not get "carried away" with excessive allocations to equities, or for that matter, real estate. As always asset allocation and low cost and broad diversification will be essential in earning one's fair share of whatever returns our financial markets are generous enough to bestow upon us.