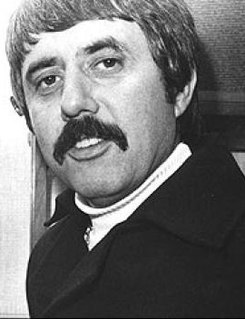

A Quote by Kenneth Fisher

Buy into good, well-researched companies and then wait. Let's call it a sit-on-your-hands investment strategy.

Related Quotes

These results add up to perhaps the most important investment lesson of all that can be drawn from this week's market anniversaries: Predicting turns in the market is incredibly difficult to do consistently well. That means that, if your investment strategy going forward is dependent on your anticipating major market turning points, your chances of success are extremely low.

I've had people say to me, "Well, how do I start collecting artworks?" Well, you start by buying. Buy what you like, buy what you can afford - and I'm not just saying that because I'm a dealer. You can't be so paralyzed to where you keep saying, "I've got to learn more." The best way to learn is to go home and actually put something on the wall. Then you've got an investment. Then you're living with it. Then you're in the game.

When the masters of industry pay such sums for a newspaper, they buy not merely the building and the presses and the name; they buy what they call the "good-will"- that is, they buy you. And they proceed to change your whole psychology - everything that you believe about life. You might object to it, if you knew; but they do their work so subtly that you never guess what is happening to you!