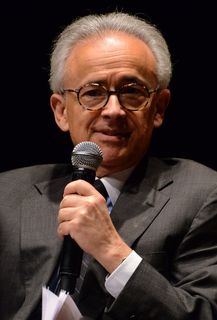

A Quote by Kenneth Fisher

Normally, the market peaks before bad news emerges. That's what happened in 1929, and that's what happened in 2000.

Related Quotes

The stock market crashed in October 1929. But that was not the cause of what caused the Great Depression. It was, in my opinion, a very minor element of it. What happened was that from 1929 to 1933 you had a major contraction which, in my opinion, was caused primarily by the failure of the Federal Reserve System, to follow the course of action for which it was set up. It was set up to prevent exactly what happened from 1929 to 1933. But instead of preventing it, they facilitated it.

Something may have happened before, and yet this thing that happened just after may be so important that you don't even know about the thing that happened before and when you tell your story to yourself, or to someone else, it's going to be told not on the basis necessarily of the time course, but rather on the basis of how it was valued by you.

If you look at what's happened to the stock market, if you look at what's happened to housing values, if you look at what's happened to bank loan portfolios because the value of their other assets that they've already issued loans against were going down, there was a pretty good argument for trying to pass something at about this level of investment with the divisions as they were - unemployment, food stamps, and tax cuts, aid to education and healthcare, and job creation.