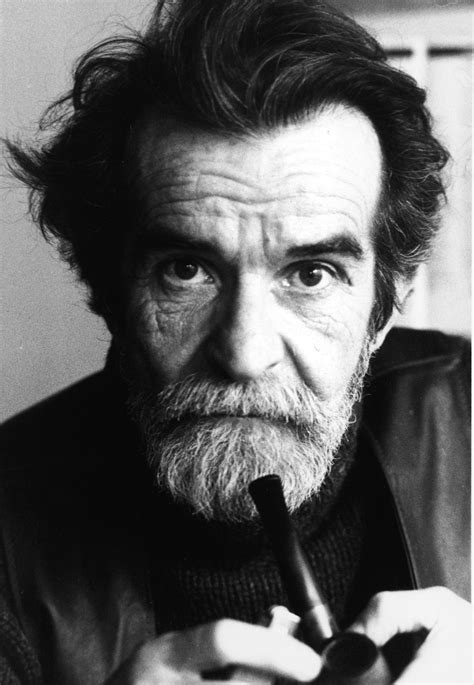

A Quote by Kenneth Fisher

In the world I've known most of my life, old stories quickly lose their power over capital markets and get replaced by new surprises. That which everyone fixates on gets priced into the stock market quickly and can't drag on.

Related Quotes

We need a federal government commission to study the way our financial services system is working - I believe it is working badly - and we also need more educated investors. There are good long term low-priced mutual funds - my favorite is a total stock market index fund - and bad short term highly priced mutual funds. If investors would get themselves educated, and invest in the former - taking their money out of the latter - we would see some automatic improvements in the system, and see them fairly quickly.

The stock market has gone up and if you are stock picking, that's fine, you may do a bit better than the market. But if you want to play in another game where you can get rapid increases of value and so on and so forth, this apparently has become the new parlour game, to invest in these companies and many their cases, the private equity that has been piling in onto of the venture capital is creating the unicorn, in other words the company with the $1 billion valuation.

There is a bit of a problem with the match between derivative securities markets and the primary markets. We have long ago instituted principles, essentially high margin requirements, to prevent certain instabilities in the stock market, and I think they're basically correct. The trouble is that there's a linkage, let's say, between something like the stock market and the index futures markets, and the fact that the margin requirements are very different, for example, played some role in the October '87 crash.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

Capital, never concerned with distribution, is now less and less concerned with production. Capital is driving for power, for the control over markets, lands, resources. Capital, in corporate hands, can move anywhere and thus demand and get the utmost in concessions and privileges as well as the freedom to operate in the interest of ever-increasing wealth and assets.