A Quote by Kenneth Frazier

I think every company has its own unique approach to creating shareholder value.

Related Quotes

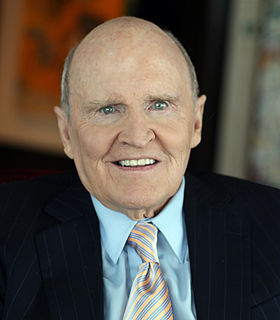

Shareholder activism is not a privilege - it is a right and a responsibility. When we invest in a company, we own part of that company and we are partly responsible for how that company progresses. If we believe there is something going wrong with the company, then we, as shareholders, must become active and vocal.

Shareholder value is the result of you doing a great job, watching your share price go up, your shareholders win, and dividends increasing. What happens when you have increasing shareholder value? You're delivering better employees to their communities and they can give back. Communities are winning because employees are involved in mentoring and all these other things. Customers are winning because you're providing them new products.