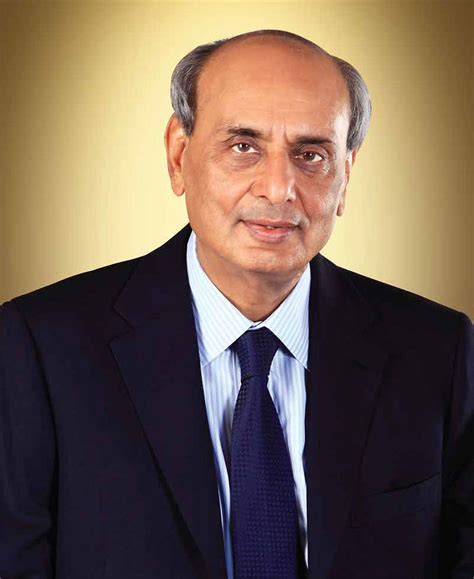

A Quote by Kenneth Langone

I think I should pay more taxes... but everything they take from me should go to reduce the debt.

Related Quotes

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

If you behave like a good citizen, and you upgrade and improve your property, your reward will be the government will take more money from you. So using that analogy, you should let your house become the shithole on the block and they'll reduce your taxes and you'll pay less. Be a bad citizen with your neighbors, right? You'll save money then.

There are two definitions of deflation. Most people think of it simply as prices going down. But debt deflation is what happens when people have to spend more and more of their income to carry the debts that they've run up - to pay their mortgage debt, to pay the credit card debt, to pay student loans.

We need a wealth tax that on a one-time basis is going to take back at least some small fraction of the great windfall that the upper 1 percent, or 5 percent and pay down the government debt, pay back the federal debt because we can't put this on the next generation or they're going to be buried paying taxes.

If you ask the question of Americans, should we pay our bills? One hundred percent would say yes. There's a significant misunderstanding on the debt ceiling. People think it's authorizing new spending. The debt ceiling doesn't authorize new spending; it allows us to pay obligations already incurred.

People tend to think that paying a debt is like going out and buying a car, buying more food or buying more clothes. But it really isn't. When you pay a debt to the bank, the banks use this money to lend out to somebody else or to yourself. The interest charges to carry this debt go up and up as debt grows.