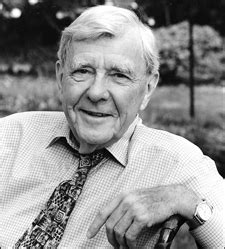

A Quote by Kerry Packer

I pay whatever tax I am required to pay under the law, not a penny more, not a penny less... if anybody in this country doesn't minimize their tax they want their heads read because as a government I can tell you you're not spending it that well that we should be donating extra.

Related Quotes

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.

I think we should have basically the same tax policy that Germany, Japan, the U.K., everybody else has, which is a tax rate in the mid-20s and no loopholes. Zero. The U.S. has the most antiquated tax system. And that means some people are going to pay more taxes, and some people are going to pay less.

If you took every single penny that Warren Buffett has, it'd pay for 4-1/2 days of the US government. This tax-the-rich won't work. The problem here is the government is way bigger than even the capacity of the rich to sustain it. The Buffett Rule would raise $3.2 billion a year, and take 514 years just to pay off Obama's 2011 budget deficit.

Multi-millionaires who pay half or less than half of the percentage of tax the rest of us pay justify their actions by saying they pay what the law requires. Though true, the fact is they found ways within the law to beat the purpose of the law - which, in the case of taxes, is that we all pay our fair share.

If I get married I get a tax break, if I have a kid I get a tax break, if I get a mortgage I get a tax break. I don't have any kids and I drive a hybrid, I think I should get a tax break. I'm trying to pay off my apartment so I have something tangible. I actually figured out if I paid off my place my reward would be that I would pay an extra four grand a year in taxes.

All I'm doing is I'm filling out my tax returns - or my accountants are, and I'm paying whatever I'm supposed to pay, though I'm giving away a large amount of the money and that probably lowers my tax rate because I'm giving away so much money. But change the law, but don't blame me for the law. I'm not writing the law. I didn't write the law.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.