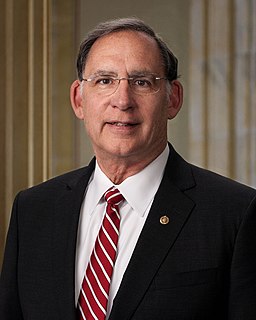

A Quote by Kevin Brady

American jobs are being lost to foreign countries, and U.S. companies are urged to move their manufacturing plants, new technologies and headquarters overseas.

Related Quotes

One thing we're going to do is talk just about that: Obamacare, jobs. Our jobs are being taken away from us. Companies, as we speak, are signing documents with Mexico and other places to move. Our jobs be being... Look at Ford two weeks ago. Ford Motor. They're gonna make all of their smaller cars in Mexico. They're gonna move everything outta here. And so many... I mean, Carrier air-conditioners. I talk about all these companies. There are hundreds of companies. They're moving out to Mexico and other countries.

In those countries where income taxes are lower than in the United States, the ability to defer the payment of U.S. tax by retaining income in the subsidiary companies provides a tax advantage for companies operating through overseas subsidiaries that is not available to companies operating solely in the United States. Many American investors properly made use of this deferral in the conduct of their foreign investment.

President Trump was determined to replace NAFTA from the day he took office. It reflected the old way of trade deals in which our partners shirked labor protections while American companies shipped operations and jobs to cheaper foreign locations. Our factories shuttered, our manufacturing shrank, and we grew more dependent on foreign suppliers.