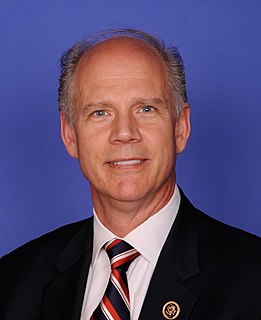

A Quote by Kevin Brady

For decades, American companies, large and small, have been competing with one hand tied behind their backs thanks to our unfair, outdated tax code.

Related Quotes

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

The reason we've been growing at 1.8 percent for the last eight, ten years, which is way below the historical average, is in large part because of our tax code. It is important to us to get the biggest, broadest tax reduction, tax cuts, tax reform that we can possibly get because it's the only way we get back to 3 percent growth. That's what's driving all of this, how do you get the American economy back on that historical growth rate of 3 percent and out of these doldrums of 1.8, 1.9 that we had of the previous Barack Obama administration?

One of the principal impediments to job creation is uncertainty on the part of American companies, large and small. We've all watched as companies have sat on a lot of capital. They're uncertain about what tax policy is going to be. They're clearly uncertain about how health care costs. They're uncertain about all the regulations on capital markets.