A Quote by Kevin Hassett

The term 'business cycle' is imprecise. Economic fluctuations affect everyone, not just businesses, and they are, unlike astral cycles, anything but regular.

Related Quotes

One of the things I've probably absorbed when I was in business school - and didn't know I was learning it - was about life cycles, that things begin, and they peak, and then they decline. So whether you look at life cycles of fashion, or you look at life cycles of things that people buy, designs, everything is in a life cycle. Getting out of the apparel businesses and into beauty and lingerie, those were very big bets, but they were very deliberately thought about and tested over time.

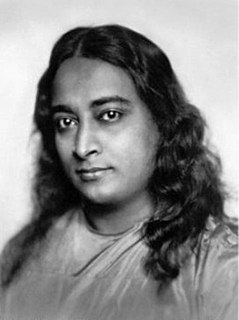

At physical death man loses his consciousness of the flesh and becomes conscious of his astral body in the astral world. Thus physical death is astral birth. Later, he passes from the consciousness of luminous astral birth to the consciousness of dark astral death and awakens in a new physical body. Thus astral death is physical birth. These recurrent cycles of physical and astral encasements are the ineluctable destiny of all unenlightened men.

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

I mean, these good folks are revolutionizing how businesses conduct their business. And, like them, I am very optimistic about our position in the world and about its influence on the United States. We're concerned about the short-term economic news, but long-term I'm optimistic. And so, I hope investors, you know - secondly, I hope investors hold investments for periods of time - that I've always found the best investments are those that you salt away based on economics.

One of our great strength, world capitalism, is the most successful economic system possible, but has also become one of shorter and shorter cycles of evaluation. CEOs, companies, stocks, profits and debits change at an ever more accelerated pace in response to the demands of stockholders and the market. We have already experienced some consequences of the shortening cycle of decision making in business, but those are minor in relation to the grand systemic collapse that always eventually results from such accelerating and shortening periods for leadership goals.