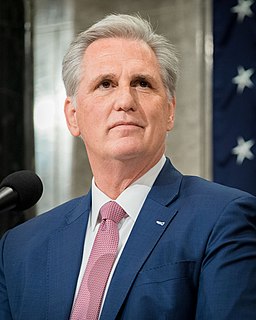

A Quote by Kevin McCarthy

In addition to billions in new 'stimulus' spending that our country can't afford, the Geithner plan also contains billions in tax increases on small and family-owned businesses while protecting the tax preferences of wealthy, multinational corporations.

Related Quotes

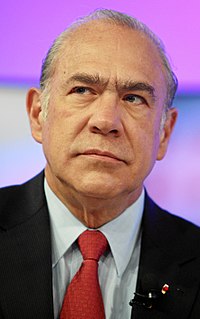

We need real tax reform which makes the rich and profitable corporations begin to pay their fair share of taxes. We need a tax system which is fair and progressive. Children should not go hungry in this country while profitable corporations and the wealthy avoid their tax responsibilities by stashing their money in the Cayman Islands.

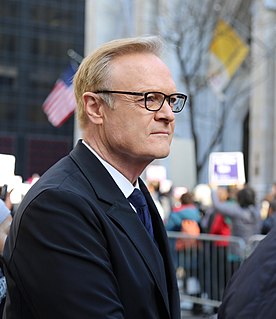

You got to remember, S corporations pay one layer of tax, corporations pay two layers of tax. So we basically see equivalent, but here`s the point. The rest of the world, they tax their businesses at an average rate in the industrialized world of 23 percent. Our corporate is 35. Our top S corporate, small business rate is 44.6 effectively. This is killing us.

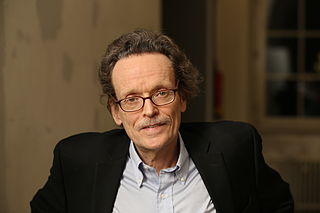

My tax plan will cut taxes for 95 percent of workers, because we need to put money back into the pockets of struggling middle-class families and close the egregious tax loopholes that have exploded over the last eight years. My plan eliminates capital gains taxes entirely for the small businesses and start-ups that are the backbone of our economy, as opposed to John McCain's plan, which would tax these businesses. John McCain is running to serve out a third Bush term. But the truth is, when it comes to taxes, that's not being fair to George Bush.