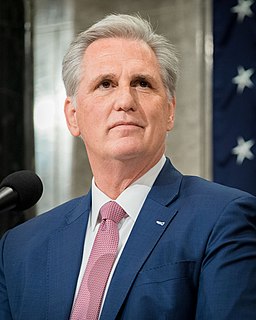

A Quote by Kevin McCarthy

We're going to do tax reform to let people keep more of what they earn, grow an economy, and be able to save for your children's future and buy a new house.

Related Quotes

I spent my whole life in the private sector, 25 years in the private sector. I understand that when government takes more money out of the hands of people, it makes it more difficult for them to buy things. If they can't buy things, the economy doesn't grow. If the economy doesn't grow, we don't put Americans to work.

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.

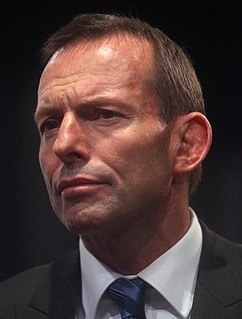

There'll be some savings from preventing double dipping by public servants which are currently able to access not one but two fully tax payer funded schemes and of course there will be out paid parental leave levy. So all up not only is this an important economic reform, an important reform to have to grow our economy more strongly, it also will leave the budget better off which will help us fix the mess that Labor has created with the budget.

In the future you're going to be able to go into a 7-Eleven and buy a ticket on a game, and people who don't use gambling as often as others do, like the people who go and buy lottery tickets, there's going to be more opportunity for people to do it. And with people casually gambling throughout the country, it's going to generate a lot of money.

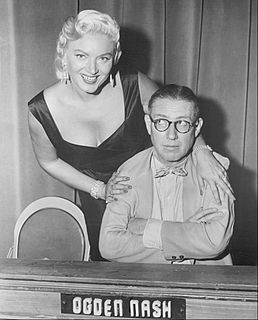

Abracadabra, thus we learn

The more you create, the less you earn.

The less you earn, the more you're given,

The less you lead, the more you're driven,

The more destroyed, the more they feed,

The more you pay, the more they need,

The more you earn, the less you keep,

And now I lay me down to sleep.

I pray the Lord my soul to take

If the tax-collector hasn't got it before I wake.

If you bring [tax] rates down, it makes it easier for small business to keep more of their capital and hire people. And for me, this is about jobs. I want to get America's economy going again. Fifty-four percent of America's workers work in businesses that are taxed as individuals. So when you bring those rates down, those small businesses are able to keep more money and hire more people.

We're going to have to invest in the American people again, in tax cuts for the middle class, in health care for all Americans, and college for every young person who wants to go. In businesses that can create the new energy economy of the future. In policies that will lift wages and will grow our middle class. These are the policies I have fought for my entire career.

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.

From 2008 to 2016 all the growth in the American economy, all the growth in national income, was earned just by the wealthiest 5% of the population. So they got all the growth. 95% of the population didn't grow. If you can get a flat tax or other lower tax, as Trump is suggesting, then this richest 5% will be able to keep even more money. That means that the 95% will be even poorer than they were before, relative to the very top.

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

You know, people like Hillary Clinton think you grow the economy by growing Washington. I think most of us in America understand that people, not the government creates jobs. And one of the best things we can do is get the government out of the way, put in reign in all the out of control regulations, put in place and all of the above energy policy, give people the education, the skills that the need to succeed, and lower the tax rate and reform the tax code.