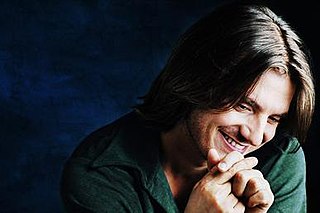

A Quote by Kevin Mitnick

All they need to do is to set up some website somewhere selling some bogus product at twenty percent of the normal market prices and people are going to be tricked into providing their credit card numbers.

Related Quotes

If you have credit card debt and credit card companies continue to close down the cards, what are you going to do? What are you going to do if they raise your interest rates to 32 percent? That's five times higher than what your kid is going to pay in interest on a student loan. Get rid of your credit card debt.

There's also consumer debt, the credit card debt that burdens many of the working families in America. Yes, we talk about national debt, and we're paying a lot down. But you're fixing to hear me tell you part of the remedy for people who have got a lot of credit card debt is to make sure people get some of their own money back.

It's critical to level the playing field, to make prices and risks clear up front, so when someone signs on for a student loan or a mortgage or a credit card, they know the tricks and traps hidden in the fine print. That's why the Consumer Financial Protection Bureau has been working on a new financial aid shopping sheet. A shorter, two-page credit card agreement, a simpler mortgage disclosure form. All those are aimed toward helping people understand the basic bargain.

I've just come to realize I'm going to share my point of view. Some people won't like me for it. Some people will. I will work every day to be as honest as I can because I do believe that we're all trying to get to the same place. But various people have tricked us into believing that we are not. And I see America going into that space.

We have this highly irrational system of incentivizing innovation for clean and green technologies, where we allow the innovator to have a temporary monopoly and then mark up the price of the product or sell licenses at high prices to those who want to use the kind of product that the innovator has invented. This system is collectively irrational because many people, to avoid the inflated prices of still-patented cleaner and greener technologies, opt for some older technology that is much more polluting.

Maybe you'll take the cash out. So a credit card company or a bank that goes into the business of saying we're going to be the broker, we're going to sell you a mortgage that you're going to be able to pay off, we're going to help you reduce your credit card debt, we're going to help you save for retirement, we're going to put you into mutual funds that have low fees rather than high fees.

In a narrow market, when prices are not getting anywhere to speak of but move within a narrow range, there is no sense in trying to anticipate what the next big movement is going to be. The thing to do is to watch the market, read the tape to determine the limits of the get nowhere prices, and make up your mind that you will not take an interest until the prices breaks through the limit in either direction.