A Quote by Kim Dotcom

Greece bankruptcy will trigger a market crash. My advice: Buy Bitcoin & Gold Both will rise when the markets crash.

Related Quotes

If the stock market does go through a crisis of confidence, which I think clearly will happen one of these days, no one can predict just like you couldn't the dot com crash or the Lehman crash, but when it goes down it will go down by thousands of points because everyone will panic. No one owns this market today because they believe there's a huge sunny future for the United States economy. They're buying because they think the Fed can keep the thing pumped up, the bubble expanding.

There is a bit of a problem with the match between derivative securities markets and the primary markets. We have long ago instituted principles, essentially high margin requirements, to prevent certain instabilities in the stock market, and I think they're basically correct. The trouble is that there's a linkage, let's say, between something like the stock market and the index futures markets, and the fact that the margin requirements are very different, for example, played some role in the October '87 crash.

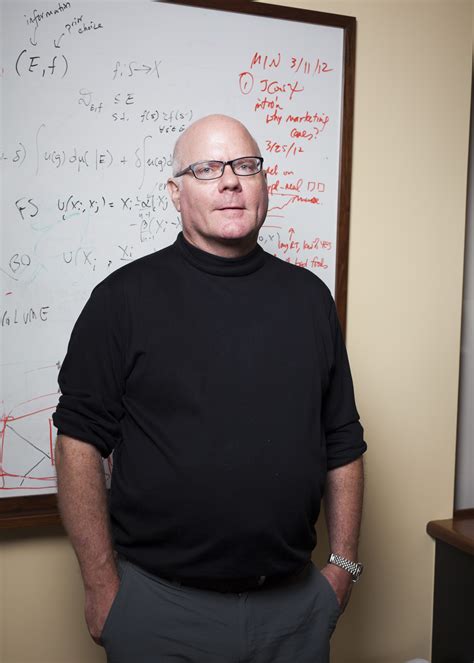

Well, bitcoin is a currency. Bitcoin has no underlying rate of return. You know, bonds have an interest coupon. Stocks have earnings and dividends. Gold has nothing, and bitcoin has nothing. There is nothing to support the bitcoin except the hope that you will sell it to somebody for more than you paid for it.