A Quote by Kristi Noem

I think we need to have competitive tax rates in order to create jobs in this country. And I think it should be fair.

Related Quotes

I think that Democrats have to think through answers we haven't in the past: How we are going to create those jobs? How should we restructure the entire tax code? Should we have things like a payroll tax, when jobs are so scarce? They weren't - basically the architecture of our employment law, tax law, all these things were from the 1930s - and I do think that one benefit of Donald Trump, which is not worth it, but one perverse thing is, he has widened the scope of things that we should discuss.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

We need real tax reform which makes the rich and profitable corporations begin to pay their fair share of taxes. We need a tax system which is fair and progressive. Children should not go hungry in this country while profitable corporations and the wealthy avoid their tax responsibilities by stashing their money in the Cayman Islands.

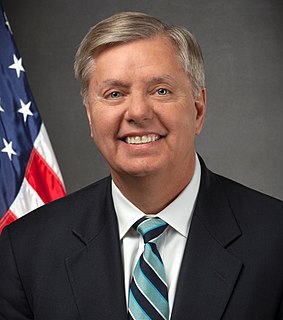

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

I think the work on tax reform, the work that's being done on regulatory reform is very important. And just having a seat at the table, I think, is so important for business today as we think about what's going to benefit the economy of this country, how we're going to create great manufacturing jobs.