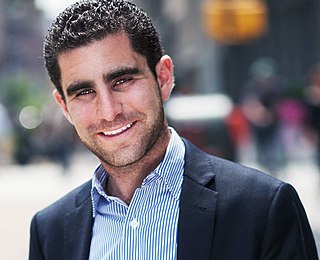

A Quote by Kurt Eichenwald

Assess Bitcoins? All you can do is examine the trading patterns, which do not provide a real analysis of any underlying economic value. The economics of investments are not solely based on supply and demand, and that is all that goes into Bitcoin prices.

Related Quotes

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

Perhaps the most widespread misunderstanding of economics is that it applies solely to financial transactions. Frequently this leads to statements that "there are noneconomic values" to consider. There are, of course, noneconomic values. Indeed, there are only noneconomic values. Economics is not a value itself but merely a method of trading off one value against another.

The real difficulty is that people have no idea of what education truly is. We assess the value of education in the same manner as we assess the value of land or of shares in the stock-exchange market. We want to provide only such education as would enable the student to earn more. We hardly give any thought to the improvement of the character of the educated. The girls, we say, do not have to earn; so why should they be educated? As long as such ideas persist there is no hope of our ever knowing the true value of education.

Almost all of the demand for oil that suddenly pushed prices up was speculative demand. People began to speculate not only in stocks and bonds and real estate, but also in commodities. The market went up for old tankers, which were used simply to store oil in. A lot of the oil was simply being stored for trading, not used.

[Wise men] have tried to understand our state of being, by grasping at its stars, or its arts, or its economics. But, if there is an underlying oneness of all things, it does not matter where we begin, whether with stars, or laws of supply and demand, or frogs, or Napoleon Bonaparte. One measures a circle, beginning anywhere.

Well, bitcoin is a currency. Bitcoin has no underlying rate of return. You know, bonds have an interest coupon. Stocks have earnings and dividends. Gold has nothing, and bitcoin has nothing. There is nothing to support the bitcoin except the hope that you will sell it to somebody for more than you paid for it.