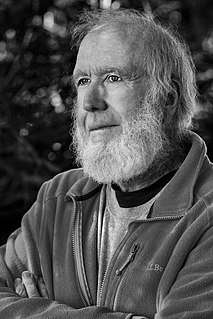

A Quote by Kurt Eichenwald

In the aftermath of the oh-so-predictable crash, the Bitcoin fanatics have begun marshaling out excuse after excuse for why this non-investment investment lost so much of its value so fast. One was that hackers attacked some of the exchanges for Bitcoins and crippled it. Really? A hacker can wreck an entire market?

Related Quotes

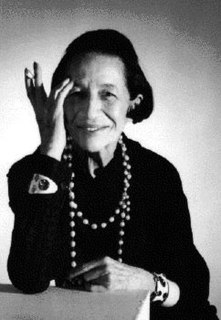

Value in relation to price, not price alone, must determine your investment decisions. If you look to Mr Market as a creator of investment opportunities (where price departs from underlying value), you have the makings of a value investor. If you insist on looking to Mr Market for investment guidance however, you are probably best advised to hire someone else to manage your money.

Ben's Mr. Market allegory may seem out-of-date in today's investment world, in which most professionals and academicians talk of efficient markets, dynamic hedging and betas. Their interest in such matters is understandable, since techniques shrouded in mystery clearly have value to the purveyor of investment advice. After all, what witch doctor has ever achieved fame and fortune by simply advising 'Take two aspirins'?

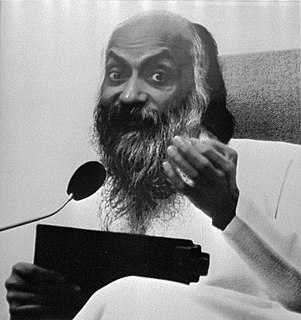

Everybody hates dependence, and that's why couples are continuously fighting, not knowing why they are fighting. They have to meditate over it, they have to contemplate over it, why they are fighting. Everything is just an excuse to fight. If you change one excuse, another excuse will be found; if no excuse is left then excuses will be invented, but somehow the fight has to be there.

There is no question that an important service is provided to investors by investment companies, investment advisors, trust departments, etc. This service revolves around the attainment of adequate diversification, the preservation of a long-term outlook, the ease of handling investment decisions and mechanics, and most importantly, the avoidance of the patently inferior investment techniques which seem to entice some individuals.

These results add up to perhaps the most important investment lesson of all that can be drawn from this week's market anniversaries: Predicting turns in the market is incredibly difficult to do consistently well. That means that, if your investment strategy going forward is dependent on your anticipating major market turning points, your chances of success are extremely low.

There’s a virtuous cycle when people have to defend challenges to their ideas. Any gaps in thinking or analysis become clear pretty quickly when smart people ask good, logical questions. You can’t be a good value investor without being an independent thinker – you’re seeing valuations that the market is not appreciating. But it’s critical that you understand why the market isn’t seeing the value you do. The back and forth that goes on in the investment process helps you get at that.

Bitcoins are not a real investment; they are bets inside a casino. If the price goes back up, don't be fooled. In the parlance of popping investment bubbles, it's something called a 'dead-cat bounce.' People who are desperate to keep the game going rush back in, hoping to bring the price back up, but it never lasts.