A Quote by L. Neil Smith

Money, first and foremost, is a medium of communication, conveying the information we call 'price'. Government control of the money supply is censorship, a violation of the First Amendment. Inflation is a lie.

Related Quotes

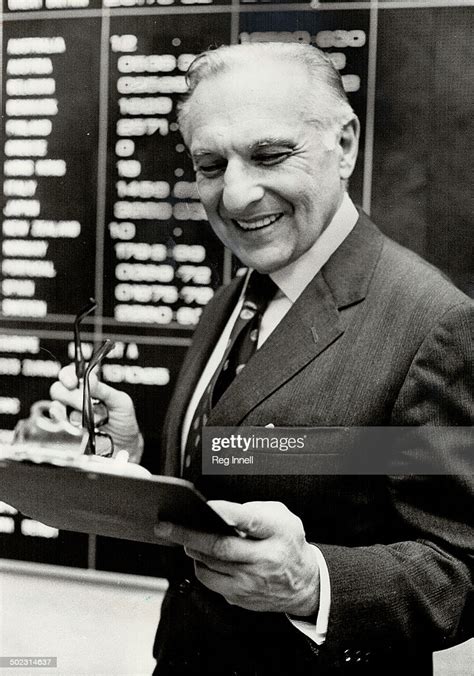

Significant changes in the growth rate of money supply, even small ones, impact the financial markets first. Then, they impact changes in the real economy, usually in six to nine months, but in a range of three to 18 months. Usually in about two years in the US, they correlate with changes in the rate of inflation or deflation."

"The leads are long and variable, though the more inflation a society has experienced, history shows, the shorter the time lead will be between a change in money supply growth and the subsequent change in inflation.

If government manages to establish paper tickets or bank credit as money, as equivalent to gold grams or ounces, then the government, as dominant money-supplier, becomes free to create money costlessly and at will. As a result, this 'inflation' of the money supply destroys the value of the dollar or pound, drives up prices, cripples economic calculation, and hobbles and seriously damages the workings of the market economy.

The depression was the calculated 'shearing' of the public by the World Money powers, triggered by the planned sudden shortage of supply of call money in the New York money market....The One World Government leaders and their ever close bankers have now acquired full control of the money and credit machinery of the U.S. via the creation of the privately owned Federal Reserve Bank.

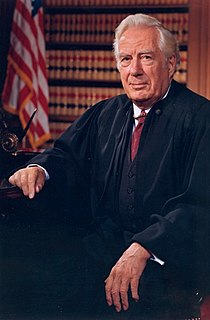

The Framers of the First Amendment were not concerned with preventing government from abridging their freedom to speak about crops and cockfighting, or with protecting the expressive activity of topless dancers, which of late has found some shelter under the First Amendment. Rather, the Framers cherished unabridged freedom of political communication.

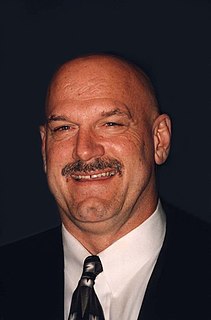

I think democracies are prone to inflation because politicians will naturally spend [excessively] - they have the power to print money and will use money to get votes. If you look at inflation under the Roman Empire, with absolute rulers, they had much greater inflation, so we don't set the record. It happens over the long-term under any form of government.

The men who wrote the First Amendment religion clause did not view paid legislative chaplains and opening prayers as a violation of that amendment... the practice of opening sessions with prayer has continued without interruption ever since that early session of Congress. It can hardly be thought that in the same week the members of the first Congress voted to appoint and pay a chaplain for each House and also voted to approve the draft of the First Amendment... (that) they intended to forbid what they had just declared acceptable.

The unique aspect of today's monetary inflation is that it is not limited to one country, but a host of countries are all inflating together. As a result of the monetary inflation (when all of the newly created money begins to leave the banks and enter the system), the price inflation will be worldwide.

To walk in money through the night crowd, protected by money, lulled by money, dulled by money, the crowd itself a money, the breath money, no least single object anywhere that is not money. Money, money everywhere and still not enough! And then no money, or a little money, or less money, or more money but money always money. and if you have money, or you don't have money, it is the money that counts, and money makes money, but what makes money make money?

Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your ass. That's why most people lose money as individual investors or traders because they're not focusing on losing money. They need to focus on the money that they have at risk and how much capital is at risk in any single investment they have. If everyone spent 90 percent of their time on that, not 90 percent of the time on pie-in-the-sky ideas on how much money they're going to make, then they will be incredibly successful investors.