A Quote by Lakshmi Mittal

We have experienced highly challenging global market conditions in the past quarter with significant steel price decline in all regions.

Related Quotes

Oil is a tangible commodity, so there is a global market. The fact that we may need less may affect the global price because we're big consumers: we probably take about a quarter of global demand. But if suddenly, let's just use a crazy example, fighting in the Middle East led to the closure of the Strait of Hormuz and no oil could get out through the Strait of Hormuz, well that would affect China, India, Europe, it will affect the whole global economy. It will affect us, too, then.

There is no significant man-made global warming at this time, there has been none in the past and there is no reason to fear any in the future. Efforts to prove the theory that carbon dioxide is a significant 'greenhouse' gas and pollutant causing significant warming or weather effects have failed. There has been no warming over 18 years.

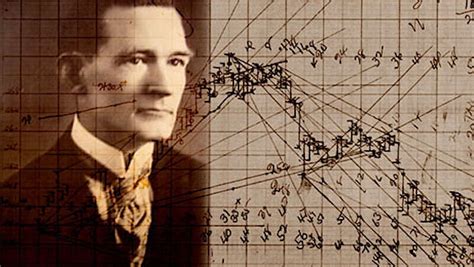

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.