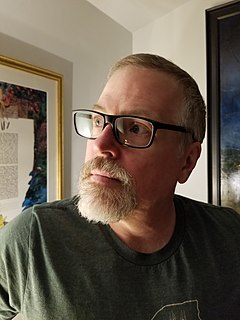

A Quote by Laura Kelly

The Brownback-Colyer administration's lack of interest in ending the border war was emblematic of economic recklessness on their watch that extended well beyond a failed tax experiment.

Quote Topics

Related Quotes

When it comes to immigration, I have actually put more money, under my administration, into border security than any other administration previously. We've got more security resources at the border - more National Guard, more border guards, you name it - than the previous administration. So we've ramped up significantly the issue of border security.

It was not until the Abraham Lincoln administration that an income tax was imposed on Americans. Its stated purpose was to finance the war, but it took until 1872 for it to be repealed. During the Grover Cleveland administration, Congress enacted the Income Tax Act of 1894. The U.S. Supreme Court ruled it unconstitutional in 1895. It took the Sixteenth Amendment (1913) to make permanent what the Framers feared -- today's income tax.

Taxing Women is a must-have primer for any woman who wants to understand how our current tax system affects her family's economic condition. In plain English, McCaffery explains how the tax code stacks the deck against women and why it's in women's economic interest to lead the next great tax rebellion.

Obama and the Democrats' preposterous argument is that we are just one more big tax increase away from solving our economic problems. The inescapable conclusion, however, is that the primary driver of the short-term deficit is not tax cuts but the lack of any meaningful economic growth over the last half decade.

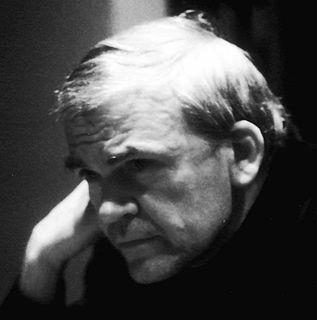

The characters in my novels are my own unrealized possibilities. That is why I am equally fond of them all and equally horrified by them. Each one has crossed a border that I myself have circumvented. It is that crossed border (the border beyond which my own "I" ends) which attracts me most. For beyond that border begins the secret the novel asks about. This novel is not the author's confession; it is an investigation of human life in the trap the world has become.

The Bush administration, they had two blue ribbon commissions about infrastructure finance that recommended a lot more money, and additionally the gas tax being increased. We couldn't get them to accept being able to move forward. Since President Obama's been in office, there has been, to be charitable, a lack of enthusiasm for raising the gas tax.

The issue here is this, that the Government's argument at the present moment is the argument that now the war is over, terrorism is defeated, we have to focus on economic development which in the north and east particular, being the areas where the war was fought, development has to proceed at a pace. That people from those parts of the country are leaving seems to suggest a lack of confidence and certainty in the trajectory of this kind of economic development.