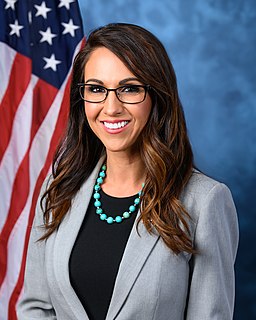

A Quote by Lauren Boebert

Congress needs to stop kicking the proverbial spending can down the road and make the hard decisions necessary to rein in our debt and balance the federal budget.

Related Quotes

If the US Government was a family—they would be making $58,000 a year, spending $75,000 a year, & are $327,000 in credit card debt. They are currently proposing BIG spending cuts to reduce their spending to $72,000 a year. These are the actual proportions of the federal budget & debt, reduced to a level that we can understand.

If we keep kicking the can down the road, if we follow the president's lead or if we pass the Senate budget, then we will have a debt crisis. Then everybody gets hurt. You know who gets hurt first and the worst in a debt crisis? The poor, the elderly. That's what we're trying to prevent from happening.

A tax cut means higher family income and higher business profits and a balanced federal budget....As the national income grows, the federal government will ultimately end up with more revenues. Prosperity is the real way to balance our budget. By lowering tax rates, by increasing jobs and income, we can expand tax revenues and finally bring our budget into balance.

I am prepared to discuss the things that I believe we need to do not just to raise the debt limit. Raising the debt limit is the easiest thing. That's one vote away. The hard thing is to show the world we are serious about putting our spending in order so we can show people we'll able to pay our bills down the road.

What would you think of a person who earned $24,000 a year but spent $35,000? Suppose on top of that, he was already $170,000 in debt. You'd tell him to get his act together - stop spending so much or he'd destroy his family, impoverish his kids and wreck their future. Of course, no individual could live so irresponsibly for long. But tack on eight more zeroes to that budget and you have the checkbook for our out-of-control, big-spending federal government.

After the $700 billion bailout, the trillion-dollar stimulus, and the massive budget bill with over 9,000 earmarks, many of you implored Washington to please stop spending money we don't have. But, instead of cutting, we saw an unprecedented explosion of government spending and debt, unlike anything we have seen in the history of our country.