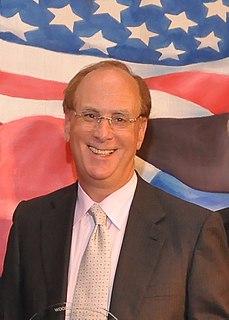

A Quote by Laurence D. Fink

Social Security is an insurance policy. It's a terrible investment vehicle. Social Security has some great benefits. But it was never meant to be a savings plan. So we need to have a national debate. Should this 12.5 percent that we're contributing all go into a Social Security pool, or should half go into a mandatory savings plan?

Related Quotes

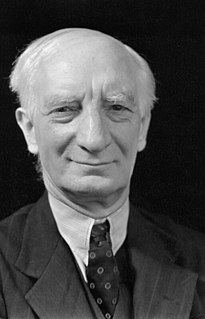

Organisation of social insurance should be treated as one part only of a comprehensive policy of social progress. Social insurance fully developed may provide income security; it is an attack upon Want. But Want is one only of five giants on the road of reconstruction and in some ways the easiest to attack. The others are Disease, Ignorance, Squalor and Idleness.