A Quote by Lawrence Kudlow

Many liberals argue that big U.S. companies don't really pay the top corporate rate. While this is sometimes true, it's mainly because, during recessions, companies lose money, and get a tax loss carryforward that temporarily reduces their effective rate. But during economic expansions, when profits rise, companies then do pay the top rate.

Related Quotes

You got to remember, S corporations pay one layer of tax, corporations pay two layers of tax. So we basically see equivalent, but here`s the point. The rest of the world, they tax their businesses at an average rate in the industrialized world of 23 percent. Our corporate is 35. Our top S corporate, small business rate is 44.6 effectively. This is killing us.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

First, the oil and gas business pays its fair share of taxes. Despite the current debate on energy taxes, few businesses pay more in taxes than oil and gas companies. The worldwide effective tax rate for our industry in 2010 was 40 percent. That's higher than the U.S. statutory rate of 35 percent and the rate for manufacturers of 26.5 percent.

Corporate tax reform is nice in theory but tough in practice. It most likely requires lower tax rates and the closing of loopholes, which many companies are sure to fight. And whatever new, lower tax rate is determined, there will probably be another country willing to lower its rate further, creating a sad race to zero.

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

Most employers I speak to, they want to create jobs and give decent salaries. Some small and medium companies say to me they cannot afford to pay the living wage. I say "what about if I gave you a business rate cut?" and they say, yes, ok. We want companies which are skilled up, generating more profit, more corporation tax - we should not be embarrassed at success, as long as they pay their taxes.

Look around. Oil companies guzzle down the billions in profits. Billionaires pay a lower tax rate than their secretaries, and Wall Street CEOs, the same ones the direct our economy and destroyed millions of jobs still strut around Congress, no shame, demanding favors, and acting like we should thank them. Does anyone here have a problem with that?

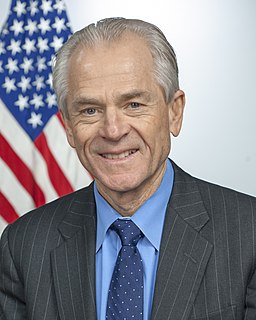

Cheap labor is a small part of the problem at work here. If it were only cheap labor, America would be in trouble. Because it's other things, too, we have a great chance to turn it around. Here's the problem: Our high corporate tax rate pushes our companies offshore. Our high regulatory burden pushes our companies offshore.