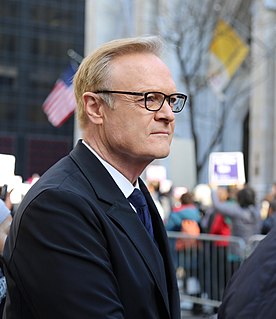

A Quote by Lawrence O'Donnell

I believe we stand strongly against having the tax code used to make the income disparity in America any worse than it already.

Related Quotes

It's one thing to maintain that upper-income earners should pay higher tax rates because they are better able to shoulder the burden for essential government services. But it's constitutional blasphemy to claim that the tax code should be used as a weapon against the wealthy and that the state should be the tyrannical arbiter of how income is distributed.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

I agree that income disparity is the great issue of our time. It is even broader and more difficult than the civil rights issues of the 1960s. The '99 percent' is not just a slogan. The disparity in income has left the middle class with lowered, not rising, income, and the poor unable to reach the middle class.

We really believe that we can bring about changes in the tax code that will make America more attractive for investment and job creation and business. But the president has also made it very clear that he wants to put - he wants to put new elements in the tax code that are going to have companies pay a price if they decide to take jobs out of the country and then sell their goods back into the United States.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

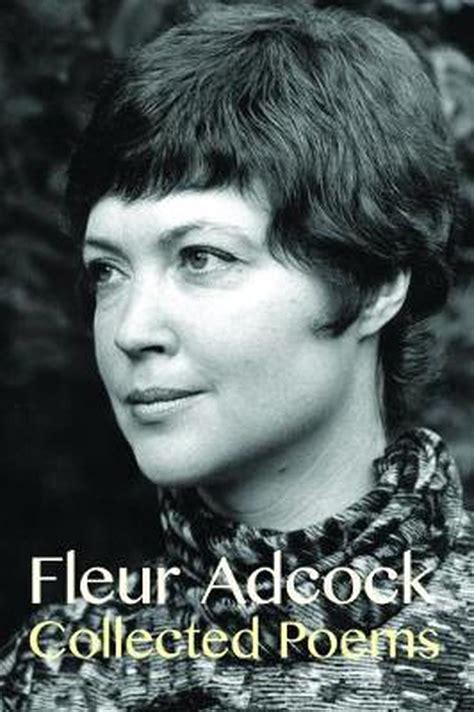

There are worse things than having behaved foolishly in public. There are worse things than these miniature betrayals, committed or endured or suspected; there are worse things than not being able to sleep for thinking about them. It is 5 a.m. All the worse things come stalking in and stand icily about the bed looking worse and worse and worse.

You can use the tax code to make people smoke less. You can use the tax code to make 'em smoke more. You can use the tax code to make 'em buy beer or buy less beer, more booze or less booze. You can screw the tax code around to make 'em make more charitable contributions. You think they're going to get rid of this power? Ain't no way, fool.

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.