A Quote by Lawrence Summers

If you look at the history of the American capital market, there's probably no innovation more important than the idea of generally accepted accountancy principles.

Quote Topics

Related Quotes

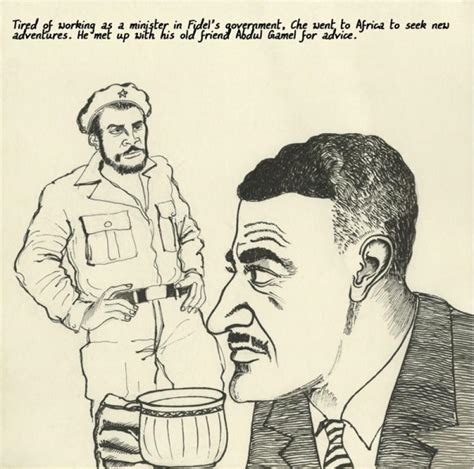

Caution in handling generally accepted opinions that claim to explain whole trends of history is especially important for the historian of modern times, because the last century has produced an abundance of ideologies that pretend to be keys to history but are actually nothing but desperate efforts to escape responsibility.

U.S. capital formation, which has been pretty high in the '90s and very high in the late 1990s, is what is being financed by the savings of the rest of the world, generally poorer than ourselves, because our deficit on current account, chronic deficit, is their surplus, and they have been willingly bringing that to the American market.

We must understand what our idea of wealth is. Is it just about more buildings, more machines, more cars, more of everything? More and more is death. In the most affluent societies in the world, for example in the United States of America, a significant percentage of the population is on anti-depressants on a regular basis. If you just withdraw one particular medication from the market, almost half the nation will go crazy. That is not wellbeing. Generally, an American citizen has everything that anyone would dream of.

There are three important principles to Graham's approach. [The first is to look at stocks as fractional shares of a business, which] gives you an entirely different view than most people who are in the market. [The second principle is the margin-of-safety concept, which] gives you the competitive advantage. [The third is having a true investor's attitude toward the stock market, which] if you have that attitude, you start out ahead of 99 percent of all the people who are operating in the stock market - it's an enormous advantage.

For values or guiding principles to be truly effective they have to be verbs. It's not "integrity," it's "always do the right thing." It's not "innovation," it's "look at the problem from a different angle." Articulating our values as verbs gives us a clear idea - we have a clear idea of how to act in any situation.

I feel history is more of a story than a lesson. I know this idea of presentism: this idea of constantly evoking the past to justify the present moment. A lot of people will tell you, "history is how we got here." And learning from the lessons of history. But that's imperfect. If you learn from history you can do things for all the wrong reasons.

We're just trying to end illegitimate government support for a single technology, which is un-American. We should be leading the world in the next generation of technological innovation. But we can't unleash private capital because of what the government is doing to stifle innovation and to choke competition.

Getting global innovation projects right is really important as they create competitive advantage two ways. When the knowledge for an innovation is from different sites around the world, it's very much more difficult for competitors to copy these innovation - they'd have to access the same knowledge from the same places. Secondly, costs and time to market can be significantly reduced leading to first mover advantage through parallel development in global projects.

The changing styles are the expression of a restless search for something which shall commend itself to our aesthetic sense; but as each innovation is subject to the selective action of the norm of conspicuous waste, the range within which innovation can take place is somewhat restricted. The innovation must not only be more beautiful, or perhaps oftener less offensive, than that which it displaces, but it must also come up to the accepted standard of expensiveness.

If you look across the economy, if you have multiple players in an industry, you have more customization, more innovation, greater choice for consumers. The more you have consolidation, the less likely you are to invest in innovation. It becomes all about driving down cost and mass production. And that's not good for innovation in an industry.