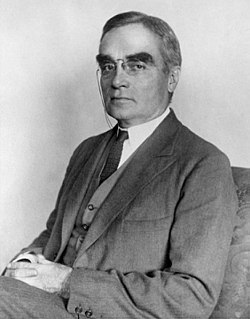

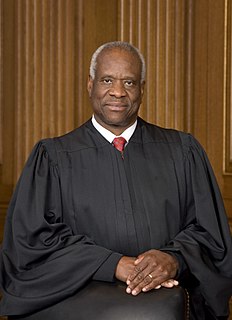

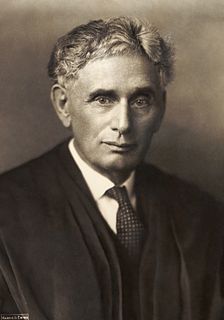

A Quote by Learned Hand

There is nothing sinister in so arranging one's affairs as to keep taxes as low as possible.

Related Quotes

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one's taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.

Taxes, well laid and well spent, insure domestic tranquility, provide for the common defense, and promote the general welfare. Taxes protect property and the environment; taxes make business possible. Taxes pay for roads and schools and bridges and police and teachers. Taxes pay for doctors and nursing homes and medicine.

The private citizen today has come to feel rather like a deaf spectator in the back row, who ought to keep his mind on the mystery off there, but cannot quite manage to keep awake. He knows he is somehow affected by what is going on. Rules and regulations continually, taxes annually and wars occasionally remind him that he is being swept along by great drifts of circumstance. Yet these public affairs are in no convincing way his affairs. They are for the most part invisible. They are managed, if they are managed at all, at distant centers, from behind the scenes, by unnamed powers.

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.