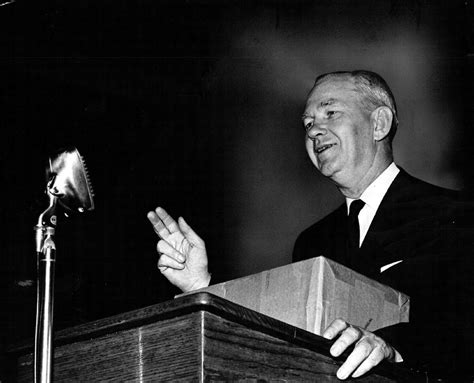

A Quote by Leonard Read

[S]tatism is but socialized dishonesty; it is feathering the nests of some with feathers coercively plucked from others - on the grand scale. There is no moral difference between the act of a pickpocket and the progressive income tax or any other social program.

Quote Topics

Related Quotes

One of the most insidious consequences of the present burden of personal income tax is that it strips many middle class families of financial reserves & seems to lend support to campaigns for socialized medicine, socialized housing, socialized food, socialized every thing. The personal income tax has made the individual vastly more dependent on the State & more avid for state hand-outs. It has shifted the balance in America from an individual-centered to a State-centered economic & social system.

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.

Mr. Speaker, in 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. Think about it, 1848 Karl Marx, Communism.... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS, my colleagues. I yield back all the rules, regulations, fear, and intimidation of our current system.

Why do we fully tax some kinds of income from capital, like interest and dividends; partially tax other kinds like capital gains; defer tax on other kinds, like IRAs; and impose no tax at all on still other types of capital income, like interest on municipal bonds? This simply is not rational. These distinctions don't have any inherent logic.

There are 11 states in the United States that in the last 50 years instituted an income tax. So I looked at each of those 11 states over the last 50 years, and I took their current economic metrics and their metrics for the five years before they put in the progressive income tax... Every single state that introduced a progressive income tax has declined as an overall share of the U.S. economy.

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

The difference between what all the people can do individually and the global consumption of nonrenewable resources is huge. The tension is... what will it take to get people to act in concert? There isn't any additive solution to the problem. It will be both governmental and social because that's the scale of the problem.