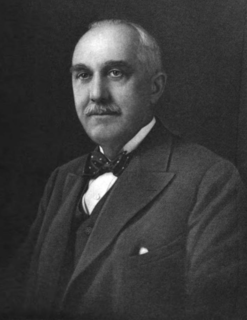

A Quote by Lewis Thompson Preston

It is the quality of lending over the quantity of lending.

Related Quotes

There are two issues that people sometimes confuse, but they're very closely related. There is the strength and the stability of the American financial system. And it's very important that that system remain stable and remain strong and lending is very important to consumers. Secondly, the economy. And what has gone on in financial system is impacting the economy. And as the economy is turning down, it is very important that lending continue to be available and be available to consumers. So what we're doing with this facility is to support - is to support consumer lending.

Our servicemembers are focused every day on serving our country. It's our job to ensure that they have everything they need to do their jobs to the best of their ability. That must include effective consumer protections against predatory lending, already afforded under the Military Lending Act, for our men and women in uniform and their families.

Hudson Taylor and Charles Spurgeon believed that Romans prohibits debt altogether. However, if going into debt is always sin, it's difficult to understand why Scripture gives guidelines about lending and even encourages lending under certain circumstances. Proverbs says "the borrower is servant to the lender." It doesn't absolutely forbid debt, but it's certainly a strong warning.

No one pushed harder than Congressman Barney Frank to force banks and other financial institutions to reduce their mortgage lending standards, in order to meet government-set goals for more home ownership. Those lower mortgage lending standards are at the heart of the increased riskiness of the mortgage market and of the collapse of Wall Street securities based on those risky mortgages.