A Quote by Liz Truss

Traditionally, Conservatives have argued that low taxes are a route to self-determination. I agree. It is vital we keep taxes low and the size of the state in check, to allow people to spend more of their own money.

Related Quotes

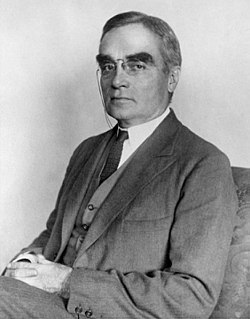

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one's taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.

I came into politics partly because I want to be able to reduce taxes so that individuals have more of their money to spend, so that businesses have more of their money to create jobs, but I believe that lower taxes are sustainable when you get the public finances in order, so I will only make promises I can keep on taxation.

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

I don't need anybody's money, it's nice.I'm totally self-funding my campaign, and the people like that, because you know, when they come to me after an election, where you win, and they say will you keep my taxes low? Or will you give us insurance here? Or do this or that or a thousand different things, or the lobbyists.

The best way to encourage economic vitality and growth is to let people keep their own money.When you spend your own money, somebody's got to manufacture that which you're spending it on. You see, more money in the private sector circulating makes it more likely that our economy will grow. And, incredibly enough, some want to take away part of those tax cuts. They've been reading the wrong textbook. You don't raise somebody's taxes in the middle of a recession. You trust people with their own money. And, by the way, that money isn't the government's money; it's the people's money.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

Lower taxes will stimulate your own personal economy by leaving more money in your pocket to do what you want - invest, save, spend, buy a bigger house, a nicer car, and give to charity. And lower taxes also lead to more money for the government to use on those things they've promised you. It's a win-win for everyone.

The most absurd public opinion polls are those on taxes. Now, if there is one thing we know about taxes, it is that people do not want to pay them. If they wanted to pay them, there would be no need for taxes. People would gladly figure out how much of their money that the government deserves and send it in. And yet we routinely hear about opinion polls that reveal that the public likes the tax level as it is and might even like it higher. Next they will tell us that the public thinks the crime rate is too low, or that the American people would really like to be in more auto accidents.