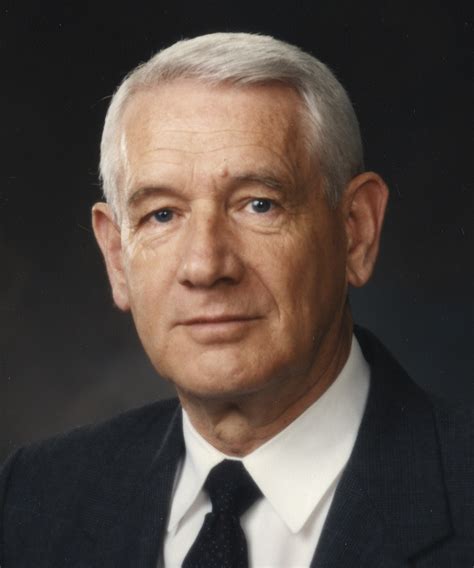

A Quote by Lloyd Blankfein

Growth requires risk-taking. If you want to dampen risk and make sure you never have a problem, you do so, but that also will have an effect on growth. This is a decision that doesn't necessarily belong to financial institutions. It belongs to regulators and legislators who represent the body politic.

Related Quotes

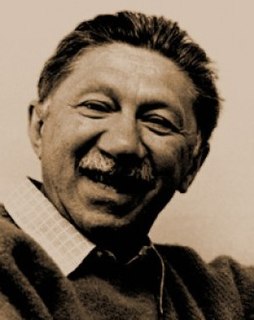

As the opportunity grows for unlimited growth and progress, the chances of failure increase. There is no such thing as a program that will provide security and growth and progress with no risk . . . even within the church. As freedom for unrestricted development is enhanced, the possibilities for failure are also increased. The risk factor is great.

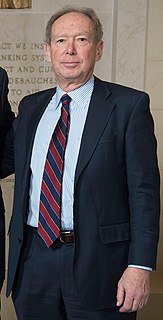

I advise other companies' CEOs, don't fall into the trap where you go, 'Where's the growth? Where's the growth?' Where's the growth?' They feel a tremendous pressure to grow. Well, sometimes you can't grow. Sometimes you don't want to grow. In certain businesses, growth means you either take on bad clients, excess risk, or too much leverage.

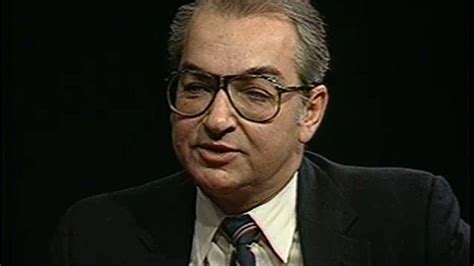

Given the central role of effective, firmwide risk management in maintaining strong financial institutions, it is clear that supervisors must redouble their efforts to help organizations improve their risk-management practices...We are also considering the need for additional or revised supervisory guidance regarding various aspects of risk management, including further emphasis on the need for an enterprise-wide perspective when assessing risk.

The banks, because of mismanagement, because of huge risk taking, are now in very vulnerable positions. We can expect that we're gonna have to do more to shore up the financial system. We also are gonna have to make sure that we set up financial regulations so that not only does this never happen again, but you start having some sort of - trust in how the credit markets work again.

To restore confidence in our markets and our financial institutions so they can fuel continued growth and prosperity, we must address the underlying problem. The federal government must implement a program to remove these illiquid assets that are weighing down our financial institutions and threatening our economy.